Yes, even millennials can fall victim to scams. It’s not just the elderly scammers are after. This isn’t the typical scam asking to repay a debt by wiring money, or putting money on a pre-paid card.

In my case, it’s a “legitimate” company that acts under false pretenses. Essentially, what they are doing isn’t illegal, but it’s a ruse: they are offering a service for a fee that you can get for free. You take one letter out of “free” and it changes the meaning.

A couple weeks ago, I got a letter in the mail saying I am eligible for student loan consolidation that would lower my monthly payment. It comes on an official-looking letterhead that gives you a number to call to get set up.

STUDENT LOAN SCAM

But the most important information on the letter is in the smallest font at the bottom of the page. Below bold, all-caps font with a number to call, it reads “CDC is not affiliated with the government or any of its programs. We offer private, fee-based application assistance to aid customers in applying for government offered programs.”

First red flag.

Of course, I didn’t read it. We’ll get to my phone conversation with this company in a minute.

The reality is that there are a lot of private companies like this one that offer to help college graduates with their student loan debt. All they really do is file paperwork to consolidate a borrowers’ federal loans into one loan.

They charge a fee, in my case almost $900, for something the U.S. Department of Education offers for free. But many borrowers like me, don’t realize this.

In August of 2015, California Attorney General Kamala Harris issued a consumer alert on student loan debt consolidation scams, outlining these same tactics to help consolidate your student loans.

“Consolidating federal student loans is FREE and can only be done through the Federal Direct Consolidation Program,” the release states. “A Direct Consolidation Loan will combine multiple federal student loans into one loan, resulting in a single monthly payment.”

STUDENT LOAN CRISIS

Like many people my age, I accumulated a massive amount of student loan debt. In my case, about $70,000 for undergrad and graduate school at two private New York universities.

And like many people who recently graduated college, I can’t afford to pay the $700 a month payment, so I settled for the Income Repayment Plan, which allows me to pay what I can based on my income.

The downside: I’m not really paying off my debt. I am essentially paying off the interest and accumulating more debt. The hope is that I can pay more off once I make more money.

The process is complicated and you’re dealing with multiple loans with different servicers, with different interest rates and different restrictions. But one thing remains certain: I am already eligible for different repayment plans that are FREE to me.

MOUNTING DEBT

I’m not alone. In 2012, student loan debt hit $966 billion, passing auto loan, credit card, and home-equity debt. Now, it’s $1.3 trillion, according to Market Watch.

Since then, student loans are the second-largest debt for households, right behind mortgages, according to a 2013 report from the Federal Reserve Bank of New York.

CERTIFIED DOC PREP SERVICES, LP

Ignoring the first red flag, I called the servicer looking to consolidate my loans. They took down my loans, income, other debt and worked out a repayment plan for me within minutes.

It turns out, my monthly payment would actually be more than what I pay now, and I owed them $899 in processing fees.

Here’s how it would work: I would make three payments of $299.67 over the next month while they temporarily placed my loans in forbearance. After I made the payments, they would pass on the consolidated loan to my servicer under the new plan.

The service rep then claimed this would make me eligible for loan forgiveness, something I learned later I was already eligible for.

To make the payments, they needed my routing and checking account number.

Second red flag.

When I asked if there was somewhere online I could go to make the payments, the service rep said no. They would call my bank the day the money was due and request to take the money out. Big, big red flag.

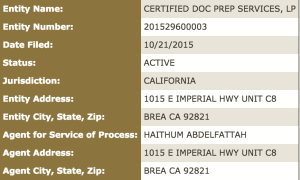

Judging by the way I sounded on the phone, he sent me a link to the Secretary of State’s website with an entity number, showing that their company, Certified Doc Prep Services, LP, was active in the state of California.

Not a scam right? Wrong.

I made my first major mistake, giving them my account information. I e-signed the loan agreement, and then got put on with someone else to go over the terms of the agreement.

I got another email outlining the next steps, which included more paperwork I needed to sign and send to them, along with my recent tax return proving my income.

It just didn’t feel right, even when the service rep sent me this letter from the White House, outlining President Obama’s plan to offer students debt relief after 20 years, and income-based repayment plans.

I did a little digging, and found out this was a scam: I was paying for services I could get for free.

I immediately canceled the agreement. No money lost, although they have some of my private information.

Like many scams, Certified Doc Services Prep, LP, is based out of Brea, Calif. and offers services to consolidate student loans for a fee. Even their website is misleading: federalstudentloanservices.com. It sounds official, but it’s not.

It’s confusing because there are student loan services, like FedLoan Servicing, the government contracts with to manage student loans.

THE TAKEAWAY

The takeaway from all this, as soon as the customer service representative tells you there’s a fee to consolidate you loans, hang up! If you get a letter stating you are eligible for loan consolidation for a fee, report it to the Consumer Finance Protection Bureau, then shred the document.

Your best bet is to work exclusively with your student loan servicer (FedLoan, CornerStone, Granite State, OSLA Servicing, etc.). You can find a complete list of servicers that work with the U.S. Department of Education here.

You can also look at switching repayment plans by going to the government’s Federal Student Aid website. They can work with you to weigh whether consolidation is right for you. There’s also the Loan Consolidation Information Call Center, 1-800-557-7392.

As you can imagine, filling out the right paperwork can be confusing and time-consuming.

Here are so pros and cons to weigh whether to consolidate your loans, according to the U.S. Department of Education’s Student Federal Aid Office:

PROS

-Simplifies loan payments by combining them into one bill

-Can lower your month payments

-Gives you up to 30 years to repay loans

-Can help raise your credit score

CONS

-Increases length of payment period

-You make more payments

-You pay more interest

-You may lose borrower benefits offered with original loan

-Once your loans are combined, they can’t be removed. The government pays off the loans before consolidating them, so they no longer exist.

Don’t be a victim! There’s help out there for those of us who need it. We are in a major student debt crisis, and companies like this only exacerbate the issue by taking advantage of misinformed graduates.

I am victim of this scam too. Did anyone ever got money back ? What action should we do ?

Hi Timothy,

I’m dealing with this company right now. But I’m so confused. What they’re offering seems legitimate but everything you’re saying aligns with what I’m going through. How did you end up canceling the contract

Hello

I have read your publication very carefully. I’m right now in a similar situation. I would like to know how I can cancel ASAP all the papers I signed with them: ‘client service agreement, ‘letter of authorization. ‘Privacy Policy’, ‘authorization debit/ credit card, student servicing plan enrollment agreement’ and ‘AUTHORIZED CHECKING AND ACH AUTHORIZATION FORM’; I signed in total 6 documents electronizally. They took me the first $ 299.67 already. Thank you for your information.

Thanks for I believed I am a victim of fraud with Cornerstone Doc Prep Inc.

You sharing this information helps so many vulnerable students looking to pay down debt. Thank you for your resourcefulness. I just received this letter and have been getting it for a long time now.

Thank you for this information, F the scammers and I am glad you had posted this

If I signed the first documents online but didn’t sign the second email they sent that I needed to send them with my proof of pay stubs what should I do? Will I have to pay something for canceling?

Thank you for posting this! Got the very same letter in the mail and almost called them before I decided to do a little research first. I hate how “official” they made the letter look, the pricks….